In a three-to-one vote on May 25, 2022, the U.S. Securities and Exchange Commission ( SEC) proposed amendments to rules and reporting forms under the Investment Company Act of 1940 that would require registered investment companies and business development companies to provide standardized environmental, social and governance (ESG) disclosure to investors and the SEC. The proposed amendments are designed to provide a consistent framework for ESG disclosure that would allow investors to compare and make more informed decisions about ESG investments. If adopted as proposed, the amendments would require new detailed ESG-related disclosures in fund prospectuses and statements of additional information (SAI) and in the management’s discussion of fund performance section of fund annual shareholder reports. The level of investor-facing ESG disclosure required by the proposed amendments would depend on the extent to which a fund incorporates ESG factors in its investment decisions. In addition, the proposed amendments would require funds to include ESG-related information in their regulatory reporting on Form N-CEN.

ESG Disclosure Requirements — Fund Prospectus and SAI

Funds are subject to disclosure requirements concerning their investment strategies. The proposed amendments would require a fund that considers one or more ESG factors as part of its principal investment strategy or investment selection process to disclose information in the fund’s prospectus and SAI. A fund would be required to disclose how it uses ESG factors as part of its investment strategy, including how it defines the relevant ESG factors. A fund would identify whether it focuses on E, S and/or G and specific issues within E, S and/or G and would be required to explain how it incorporates those particular factors into its investment selection process. For example, a fund would describe how it includes or excludes particular investments based on ESG factors.

Under the proposed amendments and as described further below, the SEC would categorize funds that incorporate ESG factors into their investment strategies as either Integration Funds or ESG-Focused Funds.

Integration Funds

The proposal defines an Integration Fund as a fund that considers one or more ESG factors along with other non-ESG factors in its investment decisions, with the ESG factors generally bearing no more significance than other factors in the investment selection process. In an Integration Fund, ESG factors may not be determinative in deciding to include or exclude any particular investment in the fund’s portfolio. An Integration Fund would be required to provide limited disclosure by summarizing in a few sentences how the fund incorporates ESG factors into its investment selection process, including what ESG factors the fund considers. The proposed disclosure item would be short and sweet so as not to overemphasize the role ESG factors play in the investment selection process. Open-end funds would be required to provide this information in the summary section of the fund’s prospectus. Closed-end funds would be required to disclose the information as part of the prospectus’s general description of the fund. The proposal contemplates a layered disclosure approach and as such, the summarized description would be complemented by a more detailed description of the fund’s integration of ESG factors in its investment selection process, in an open-end fund’s statutory prospectus or later in a closed-end fund’s prospectus. Integration Funds would be permitted to mention ESG factors in their advertisements or sales literature. That includes permission to discuss the relationship between ESG factors and other investment factors. However, Integration Funds would not be permitted to describe ESG factors as a significant or main consideration in the fund’s investment or engagement strategy.

The SEC also proposed prohibiting Integration Funds from using a name that includes terms indicating that the fund’s investment decisions incorporate one or more ESG factors (Client Alert June 8, 2022).

ESG-Focused Funds

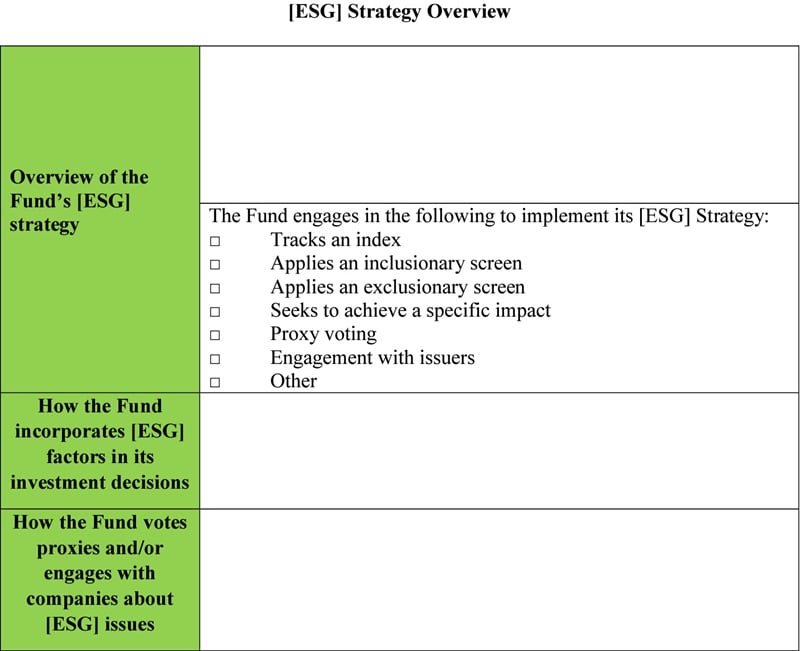

The proposal defines an ESG-Focused Fund as a fund that focuses on one or more ESG factors by using them as a significant or main consideration in selecting investments, or in its engagement strategy with the companies in which it invests. ESG-Focused Funds would include (i) funds that track an ESG-focused index; (ii) funds that apply inclusionary or exclusionary screens; (iii) funds that focus on ESG-related engagement with the issuers in which they invest; and (iv) funds that seek to achieve a particular ESG impact. ESG-Focused Funds would also include any fund that markets itself, whether through its name or advertisements or sales literature, as incorporating one or more ESG factors by using them as a significant or main consideration in the investment decision process. All ESG-Focused Funds would be required to provide more detailed information in a tabular format, as shown below, in the fund’s prospectus. Open-end funds would be required to provide this ESG Strategy Overview Table at the beginning of its “risk/return summary,” while closed-end funds would provide the table at the beginning of the discussion of the fund’s organization and operation.

An image of the ESG Strategy Overview from the SEC

The SEC’s layered disclosure approach would require an ESG-Focused Fund to complete each row with the brief disclosure required by that row — and only the information required by the relevant form instructions — with lengthier disclosure or other available information required elsewhere in the prospectus. The disclosure required by each component of the table is outlined below.

Row One: Overview: An ESG-Focused Fund would provide a concise description of the factor(s) that are the focus of the fund’s ESG strategy, along with a list of common ESG strategies as shown in the ESG Strategy Overview table and, in a “check the box” style, indicate all strategies in that list that apply.

Row Two: Description of fund’s incorporation of any ESG factors: An ESG-Focused Fund would provide a summary of how the fund incorporates ESG factors into its process for evaluating, selecting, or excluding investments.

- If the fund applies an inclusionary or exclusionary screen to select or exclude investments, the fund’s summary must briefly explain the factors the screen applies — such as particular industries or business activities it seeks to include or exclude, and any exceptions that apply. The fund would also be required to state the percentage of its portfolio, in terms of net asset value, to which the screen applies — if less than 100%, excluding cash and cash equivalents held for cash management — and to explain briefly why the screen applies to less than 100% of the portfolio. For funds that apply the screen to their entire portfolio, the proposed rule would provide an exception for cash management with respect to small amounts used for operational purposes, such as meeting redemptions.

- If the fund uses an internal methodology, a third-party data provider or a combination of both to evaluate, select or exclude investments, the fund must describe how it uses the methodology, third-party data provider, or combination of both, as applicable. If the fund used a third-party data provider, the fund would provide a more detailed description of the scoring or ratings system used by the third-party data provider in addition to a description of the fund’s method of evaluating the quality of the data from such providers.

- If the fund tracks an index, the summary must identify the index and briefly describe the index and how it utilizes ESG factors in determining its constituents. Specifically, a fund tracking an index also would provide later in the prospectus the index’s methodology, including any criteria or methodologies for selecting or excluding components of the index that are based on ESG factors.

- ESG-Focused Funds would also provide an overview of any third-party ESG frameworks that the fund follows as part of its investment process such as the United Nations Sustainable Development Goals or the United Nations Principles for Responsible Investing.

Row Three: Proxy voting or engagement with companies: Funds for which engagement with issuers, either by voting proxies or otherwise, is a significant means of implementing their ESG strategy (e.g., funds that proactively use proxy voting or engagement with issuers as a means of implementing their ESG strategy) must check the appropriate box in Row One of the ESG Strategy Overview Table. A fund that checks either the proxy voting or engagement box in Row One indicating that proxy voting or engagement with issuers is a significant means of implementing its ESG strategy would be required to provide a brief narrative overview in Row Three of how the fund engages with portfolio companies on ESG issues. The fund would identify the specific methods, both formal and informal, that it uses to influence portfolio companies. The fund would also disclose whether it has specific or supplemental proxy voting policies and procedures that include one or more ESG considerations for companies in its investment portfolio, including which ESG considerations those policies and procedures would address. Further, an ESG-Focused Fund that has adopted an engagement strategy to engage with issuers on ESG matters other than through voting proxies, would be required to disclose in Row Three an overview of the objectives it seeks to achieve through those methods.

The proposed amendments would also require that a fund that does not check the proxy voting box or the engagement box in the first row, indicating that engagement with issuers is not a significant means of implementing its ESG strategy, to nevertheless disclose that neither proxy voting nor engagement with issuers is a significant means of implementing its investment strategy in Row Three of the ESG Strategy Overview Table.

Impact Funds

The proposal defines an Impact Fund as an ESG-Focused Fund that seeks to achieve a specific ESG impact or impacts. Impact Funds would have additional disclosure requirements in the ESG Strategy Overview Table and later in the prospectus. An Impact Fund would be required to disclose in Row One (i) how it measures progress toward the specific impact — including the key performance indicators it analyzes; (ii) the time horizon the fund uses to analyze progress; and (iii) the relationship between the impact the fund is seeking to achieve and financial return(s). In Row Two, the fund would provide an overview of the impact(s) it is seeking to achieve and how it is seeking to achieve the impact(s). In addition, the fund would disclose in its investment objective the ESG impact that the fund seeks to generate with its investments.

In the proposing release, the SEC also reaffirms its belief that existing obligations for funds under the Investment Company Act compliance rules contemplate that funds’ compliance policies and procedures would address the accuracy of ESG-disclosures including their portfolio management processes.

Greenhouse Gas (GHG) Emissions Disclosure

Under the proposed amendments, funds (including Integration Funds and ESG-Focused Funds) that consider environmental factors in their investment strategies would also be required to disclose certain information regarding GHG emissions associated with their investments. We will provide a more detailed analysis of these requirements in a future publication.

Unit Investment Trusts (UITs)

UITs that provide exposures to portfolios selected based on any ESG factors would be required to explain in their registration statements how those factors were used to select the portfolio securities. Due to the unmanaged nature of UITs, the proposed amendments with respect to UITs’ ESG disclosure are less detailed and not differentiated on the same Integration/ESG-Focused basis.

Inline XBRL Data Tagging

The proposed amendments would require funds that include the ESG-related registration statement disclosure and fund annual report disclosure to file this information with the SEC using a structured, machine-readable data language (Inline XBRL).

Fund Annual Report ESG Disclosure

The proposed amendments to fund annual reports would require ESG-Focused Funds, including Impact Funds, to provide additional ESG-related information therein. For registered investment companies, the proposed disclosure would be included in the management’s discussion of fund performance section of the fund’s annual shareholder report. For business development companies, the proposed disclosure would be included in the management discussion and analysis section of the fund’s annual report on Form 10-K.

- An Impact Fund would be required to discuss the fund’s progress on achieving its impact in both qualitative and quantitative terms during the reporting period and the key factors that materially affected the fund’s ability to achieve its desired impact.

- Funds that use proxy voting as a significant means of implementing their ESG strategy would be required to disclose certain information regarding how the fund voted proxies relating to portfolio securities on ESG issues during the reporting period. Specifically, the fund would be required to disclose the percentage of ESG-related voting matters during the reporting period for which the fund voted in furtherance of the initiative. The fund would be permitted to limit the disclosure to voting matters involving ESG factors that the fund incorporates into its investment decisions. Additionally, a fund would be required provide a cross reference or hyperlink to the fund’s most recent complete proxy voting record filed on Form N-PX.

- Funds for which engagement with issuers on ESG issues through means other than proxy voting is a significant means of implementing their ESG strategy would also be required to disclose progress of all key performance indicators of such engagements. Specifically, the disclosure would include the number or percentage of issuers with whom the fund held ESG engagement meetings during the reporting period related to one or more ESG issues and the total number of ESG engagement meetings. “ESG engagement meeting” for this purpose would mean a substantive discussion with management of an issuer advocating for one or more specific ESG goals to be accomplished over a given time period, where progress that is made toward meeting such goal is measurable, that is part of an ongoing dialogue with management regarding this goal.

Regulatory Reporting on Form N-CEN

The proposed amendments would add proposed Item C.3(j) to Form N-CEN, which asks specific questions tailored to ESG funds’ strategies and processes. In particular, the amendment would require a fund that indicates that it incorporates ESG factors to report the following:

- The type of ESG strategy it employs (i.e., Integration, ESG-Focused, or Impact) as defined in the proposed amendments (and if an Impact Fund, to identify that it is both an ESG-Focused Fund and an Impact Fund.

- The ESG factor(s) it considers (i.e., E, S and/or G).

- The method(s) it uses to implement its ESG strategy (i.e., tracking an index, applying an inclusionary and/or exclusionary screen, proxy voting, engaging with issuers and/or other methods).

- If the fund considers ESG-related information or scores provided by ESG consultants or other ESG service providers in implementing its investment strategy, to identify whether any such service provider is an affiliated person of the fund and any associated legal name and legal entity identifier (LEI), or provide and describe other identifying number of each such service provider.

- Whether the fund follows any third-party ESG framework(s) and the full name of such framework(s).

In addition, the proposed amendments would require all index funds to report the name and LEI, if any, of the index the funds track (or provide and describe other identifying number of such index).

Request for Comment and Compliance Periods

The public comment period will remain open for 60 days following the publication of the proposing release in the Federal Register. The SEC has proposed a one-year compliance period for the proposed fund prospectus disclosure requirements, UIT registration statement disclosure requirements and regulatory reporting requirements on Form N-CEN. The proposed annual shareholder report disclosure requirements would have an 18-month compliance period. In the proposed rule release, the SEC directs approximately 200 requests for comment to the investment adviser and fund industry relating to each element of the rule proposal as it looks to finalize the rules.

Conclusion

Given the significant inflow of capital in recent years to ESG-related services and investment products, the proposed new requirements seek to provide consistent, comparable and reliable information among investment products and advisers that claim to consider one or more ESG factors. The proposed common ESG disclosure framework is the latest step in the SEC’s efforts to curb “greenwashing” (the practice of exaggerating or overemphasizing ESG practices and the role ESG factors play in a fund’s or adviser’s strategy) and facilitate better informed ESG-related investment decisions. The industry’s responses to the SEC’s requests for comment could have a large impact on how closely the final rule tracks the rule proposal. Please reach out to your Faegre Drinker ESG investment management team to discuss the rule proposal further or if you would like assistance preparing a comment letter.

.svg?rev=a492cc1069df46bdab38f8cb66573f1c&hash=2617C9FE8A7B0BD1C43269B5D5ED9AE2)