Medicare Advantage (MA) is the rapidly growing private plan option in the Medicare program. More than one-third of all Medicare beneficiaries choose MA — more than 24 million people. The program has grown nearly 10% year over year, and enrollment is expected to top 30 million in the next few years.

While all MA plans must provide services covered by Medicare Part A and Part B, MA plans that can offer these services for less than original Medicare split the money with the government and then reinvest the remaining savings to purchase supplemental benefits for their members. A string of policy changes permitted MA plans, starting in Plan Year 2019, to offer a much more comprehensive range of supplemental benefits and tailor these benefits for specific health conditions. (You can learn more about the specifics of these policy changes here and here.)

Collectively, these policy changes and the resulting innovations in benefits and services are transitioning MA from a health insurance program into the nation’s first large-scale population health program. These new offerings also add significant marketing sizzle to MA’s annual campaign to win new members. Now that marketing for Plan Year 2021 is underway, this is an excellent time to check on 2021 MA supplemental benefits and compare them to supplemental benefits in 2018, 2019 and 2020.

As shown in Table 1 below, the most popular supplemental benefits continue to be benefits with a long history in the MA program — including optical, audio and dental benefits, and relatively low-cost benefits that plug holes in original Medicare’s idiosyncratic benefit structure. While readers familiar with MA benefits will not be surprised by the benefits on this list, they might be surprised by how many plans continue not to offer them.

| Table 1: Eight Most Popular Supplemental Benefits for 2021 | ||

|---|---|---|

| SUPPLEMENTAL BENEFIT CATEGORY | COUNT OF PLANS | PERCENT OF PLANS* |

| Eye Exams | 4,851 | 76% |

| Hearing Exams | 4,618 | 72% |

| Fitness Benefit | 4,593 | 72% |

| Eyewear | 4,577 | 71% |

| Worldwide Emergency/Urgent Coverage | 4,571 | 71% |

| Preventive Dental | 4,483 | 70% |

| Outpatient Blood Services | 4,435 | 69% |

| Hearing Aids | 4,424 | 69% |

| *Out of 6,403 plans, excluding MSA, National PACE and some 1876 Cost plans | ||

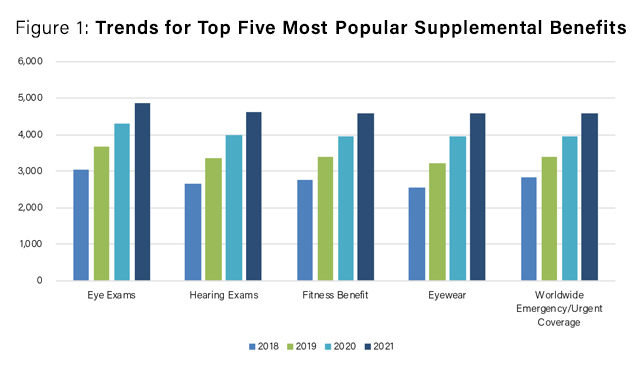

Figure 1 below shows that, across the board, the number of plans that offer the most popular supplemental benefits has increased every year since 2018.

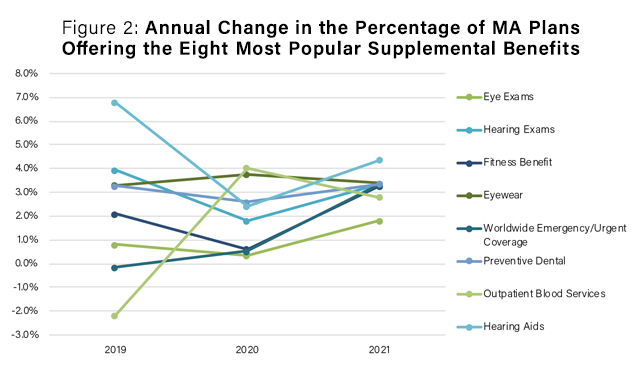

Figure 2 below analyzes the annual change in the percentage of MA plans offering the top eight supplemental benefits compared to total plans offered. We saw a decrease in outpatient blood services, a benefit that is difficult to market, as plans increase more marketable supplemental benefits. All other popular benefits are increasing in frequency. The percentage of total plans offering hearing aids, for example, as a supplemental benefit was the largest increase.

In Table 2 below, we show the variation in the most popular supplemental benefits based on the percentage of plans that offer the benefit within plans of the same product type. We note that preferred provider organizations (PPOs) tend to offer these benefits less frequently than health maintenance organizations (HMOs), with PPOs offering them, on average, 60% of the time and HMOs offering them, on average, 70% of the time. (HMOs and PPOs make up about 97% of all MA plans.)

|

Table 2: Top Eight Most Popular Supplemental Benefits for 2021 by Plan Type |

|||||

|---|---|---|---|---|---|

| SUPPLEMENTAL BENEFIT CATEGORY | HMO & HMO POS | LOCAL & REGIONAL PPO | D-SNP | MMP HMO | PFFS & 1876 Cost |

| Eye Exams | 78% | 70% | 89% | 98% | 82% |

| Hearing Exams | 75% | 66% | 87% | 79% | 58% |

| Fitness Benefit | 74% | 68% | 86% | 51% | 69% |

| Eyewear | 75% | 64% | 89% | 98% | 48% |

| Worldwide Emergency/Urgent Coverage | 73% | 67% | 81% | 21% | 90% |

| Preventive Dental | 72% | 67% | 87% | 58% | 55% |

| Outpatient Blood Services | 70% | 66% | 78% | 93% | 92% |

| Hearing Aids | 73% | 62% | 86% | 100% | 47% |

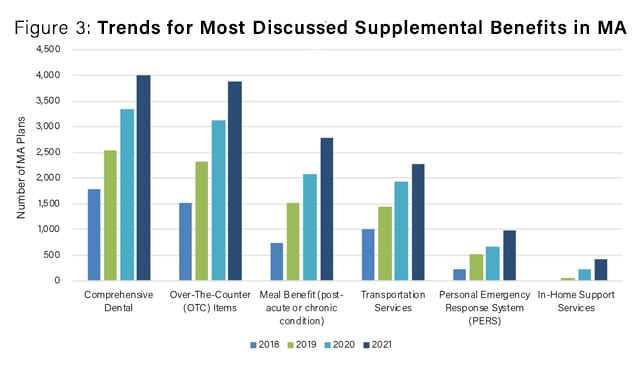

Over the last two years, we have consulted a number of MA organizations, associations and vendors about the new supplemental benefit flexibilities. In these touch points, certain benefits are consistently discussed for their potential to provide a positive return on investment (because the costs avoided as a result of the benefit exceed the cost of the benefit) or marketing sizzle. Figure 3 below shows the rising popularity of these most discussed benefits. Readers will note that some of the benefits (Comprehensive Dental and Over-the-Counter Drugs, in particular) are now common MA plan offerings. Transportation and meal benefits are also gaining in popularity. Other much-talked-about benefits, such as in-home support, remain uncommon but are growing.

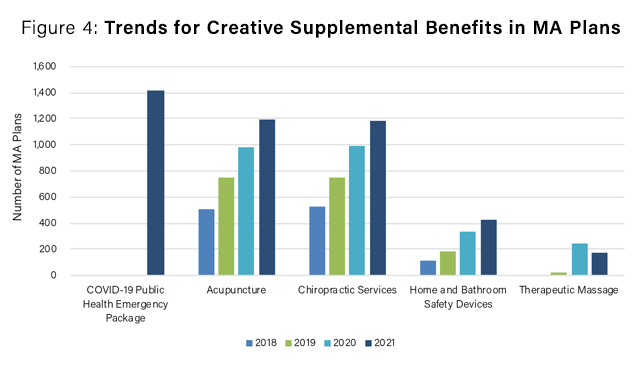

Still, other benefits have been the subject of much discussion for their potential to treat chronic conditions in new ways. These range from covering new provider types — such as acupuncturists, therapeutic massage and chiropractors (beyond existing Medicare-covered chiropractic services) — to creative benefits that increase member safety, such as bathroom/home safety devices. Figure 4 below demonstrates a considerable rise in the number of MA plans covering new provider types, particularly with regard to acupuncture and chiropractic services. There is less uptake on creative new benefits to increase member safety.

The Impact of COVID-19

COVID-19 creates unprecedented challenges for health plans serving a senior population that is more vulnerable to the virus and especially impacted by social distancing and shelter-in-place public health directives. Even before the pandemic, the senior population had high rates of social isolation, depression and financial anxiety. These underlying problems can exacerbate expensive chronic diseases. In 2020, using flexibilities provided by the Centers for Medicare and Medicaid Services (CMS), MA plans started offering services specifically to address the problems related to COVID-19 and the COVID-19 public health emergency. The trend continues in 2021. Over 1,400 MA plans will offer kits and other items to members designed to make it easier to comply with social distancing and public health orders.

To the best of our knowledge, our analysis is the only report that shows trendlines in MA supplemental benefits over each year since the CMS rule changes — and we think this paper has great value in that context. Yet, it must be acknowledged that there are limitations to this work, including the following:

- The CMS benefit data files contain curious labeling of benefits that have evolved as CMS has attempted to keep pace with all of the innovation it has unleashed. This could create differences in interpretation for certain benefits. For this reason, another researcher looking at the same data might arrive at somewhat different numbers for certain benefits.

- The numbers above do not control for enrollment or plan service area. For example, the plans offering a given benefit may skew toward lower enrollment or smaller service areas, thus creating the potential for our graphics to implicitly overstate the number of Medicare beneficiaries with access to that benefit. The converse is also true.

- Not all innovations are easily reported in tables. For example, based on our review of MA organization press releases, a number of MA plan sponsors are now offering certain drugs with $0 copays, grocery subsidies for healthy foods, and plans tailored for veterans who receive some of their care from the Department of Veterans Affairs. We do not capture all of the richness in innovations in our tables.

- Finally, the numbers above do not (yet) include condition-specific benefits (for example, pest control for people with COPD or asthma). CMS will not make this data available until early next year. When condition-specific benefits are made available, we will be pleased to offer further insights in Part II of this report.

If the transformation of MA benefits interests you as much as us, or if you would like to learn more about our MA benefits database and ever-evolving bibliography on benefit innovations (well over 500 articles), contact the authors.

.svg?rev=a492cc1069df46bdab38f8cb66573f1c&hash=2617C9FE8A7B0BD1C43269B5D5ED9AE2)