Medicare Advantage (MA) is the private plan option in the Medicare program. Over the last few years, the program has grown rapidly, nearly 10% a year. More than one-third of Medicare beneficiaries (people with Medicare) have opted into MA, and the total number of MA enrollees is expected to top 30 million in the next few years.

One of the primary reasons for the recent growth of MA is the breadth of supplemental benefits that plans offer to their enrollees. While MA plans have long offered enrollees supplemental benefits – such as vision, hearing, and limited dental coverage, the Trump Administration has enabled MA plans to offer a wider array of benefits and to make the benefits disease- or condition-specific.

One example of such a benefit is free podiatry for members with diabetes. An insurer likely would not offer all members free podiatry. That benefit would cost too much money for the modest improvements in health status for the plan’s total membership. However, a plan might find it an excellent investment to offer free podiatry to members with diabetes so that those specific members are incented to have minor foot wounds treated quickly — thereby lessening the need for more invasive, and expensive, procedures.

In addition to these flexibilities, in 2020, for the first time, MA plans are offering special benefits for a category of members with serious, and recurring, illnesses. The Special Supplemental Benefits for Chronic Illnesses (SSBCI) are non-medical services that may be helpful for preventing complications related to serious illnesses, — such as pest control for people with severe asthma. These policy changes are discussed in our previous briefs on MA supplemental benefits, here and here. Collectively, these new benefit flexibilities — which have the potential to improve outcomes, finance themselves with cost offsets, and further drive the growth of the program — are changing MA into the country's first nationwide population health platform.

Last fall, when the 2020 MA benefits data first became available, we reported on important changes in generally available supplemental benefits in MA plans. That report can be accessed here. Now that CMS has released the condition-specific and SSBCI benefits, this report completes our analysis of the 2020 MA supplemental benefit landscape.

Condition-Specific Benefits

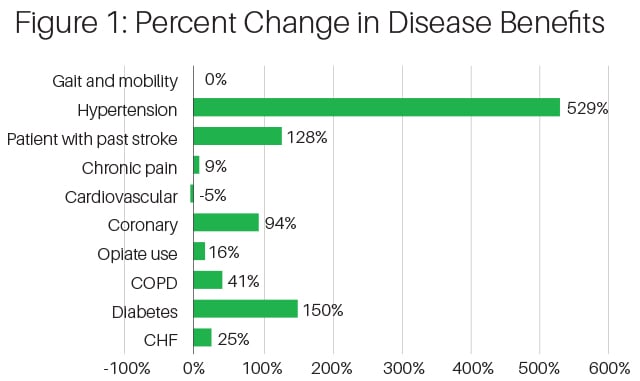

The total number of condition-specific benefits has risen markedly from approximately 820 in 2019 to 1850 in 2020. The majority of condition-specific benefits in 2020, just as in 2019, are focused on diabetes, congestive health failure (CHF), or chronic obstructive pulmonary disease (COPD), three relatively prevalent and expensive conditions. Beyond these conditions, there are some noticeable changes between 2020 and 2019. Condition-specific benefits for hypertension rose 529% in 2020, and condition-specific benefits for coronary artery disease rose 94%. Of the top ten most prevalent conditions, the number of condition-specific benefits dropped for only one condition: cardiovascular disease. MA plans are providing condition specific benefits for 41 specific diseases in 2020, compared to 25 for 2019.

In Figure 1 below, we list the top ten most prevalent diseases and their percent change from 2019 into 2020.

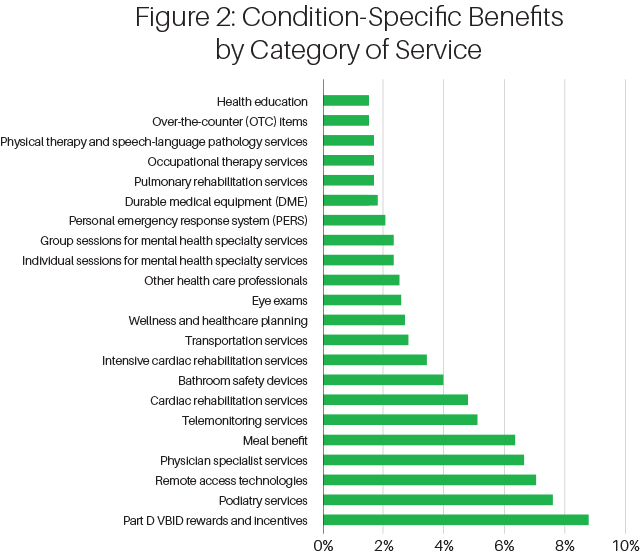

In Figure 2 below, we list the most common 2020 condition-specific benefits is below. See Figure 2.

The benefits offered for members with these particular conditions ranged considerably from reduced cost-sharing on covered services (behavioral health, physical and occupational therapy, durable medical equipment) to expansions of widely available supplemental benefits (over-the-counter drug benefits, comprehensive dental, eye exams) to newer benefits offered exclusively for one or more of the diseases above (meals, transportation, acupuncture, therapeutic massage).

Condition-Specific Benefits With Prerequisites

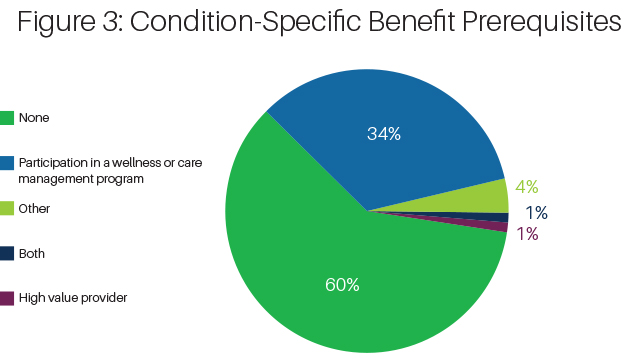

MA plans are permitted to establish prerequisite that accompany the condition-specific benefit. Care management programs, for example, are helpful in successfully controlling certain chronic diseases. For this reason, an MA plan might want to link access to a condition-specific benefit to participation in the care management program. In Figure 3 below, we show that the majority of plans do not tie the condition-specific benefit to a prerequisite, but slightly more than one-third of plans do.

SSBCIs

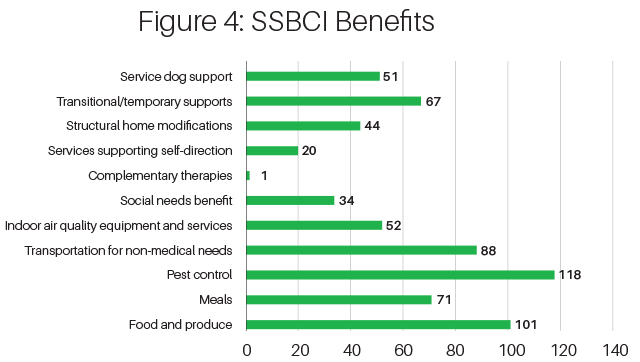

For the first time in 2020, MA plans can offer benefits that do not need to meet the government's definition of "primarily health-related" when they are focused on a condition that meets the government's definition of a severe chronic illness. The initial uptake on these benefits in 2020 is modest. SSBCIs are being offered in 245 plans. There are roughly 6,000 plans in the MA market in 2020 (including employer-only plans). In Figure 4 below, we show the most common SSBCIs in 2020.

Rate of Adoption MA Organizations

We also explored the range of adoption of condition-specific benefits across Medicare Advantage organizations and discovered great variation. Among Medicare Advantage organizations with significant MA membership, 10 have more than 50% of their members in plans with condition-specific benefits. None of the national MA organizations reach this level, but one has 43% of its members in plans with condition-specific benefits. In contrast, many MA organizations are not yet utilizing condition-specific benefits.

Rapidly Adapting, but a Long Way to Go

It is important to remember that we are still very early in a multi-year process. Beyond benefits, MA plans are also increasingly offering innovations through other vehicles — care management programs, reward and incentive programs, and value-added services. There are pros and cons to each of these alternative vehicles that are beyond the scope of this report. But our conversations with and counsel to numerous MA organizations on these topics demonstrate that the water’s edge of service innovations in MA plans goes beyond the annual benefit filings with CMS.

Other promising flexibilities — such as using benefits to drive members to "high value" providers or offering benefits based on low-income status — are barely being employed. This will almost certainly change in the coming years as MA organizations, through continued analysis and a fair amount of trial and error, learn what works. Nonetheless, the advances in 2020 summarized above demonstrate that MA organizations, as a whole, recognize the exceptional potential for these benefits to drive enrollment, improve outcomes and enable net cost savings.

If the transformation of Medicare Advantage benefits and other innovations interests you as much as us, or if you would like to learn more about our MA benefits database and ever-growing bibliography of benefit innovations, contact the authors.

.svg?rev=a492cc1069df46bdab38f8cb66573f1c&hash=2617C9FE8A7B0BD1C43269B5D5ED9AE2)