The pandemic has upended industries across the globe. And while federal and state governmental programs have generously provided aid to certain individuals and corporate entities, such aid currently does not relieve taxpayers from paying one’s property taxes in Colorado.

While the need to pay taxes remains unavoidable even under COVID-19, a property taxpayer can challenge the amount owed if she or he believes their property has been valued too high. These appeal rights are particularly salient in 2021 since the heart of pandemic lockdowns coincided with the date under which real property must be valued under Colorado’s property tax system. As such, certain property taxpayers may have a strong argument that their property taxes should go down in 2021 from their previous assessments.

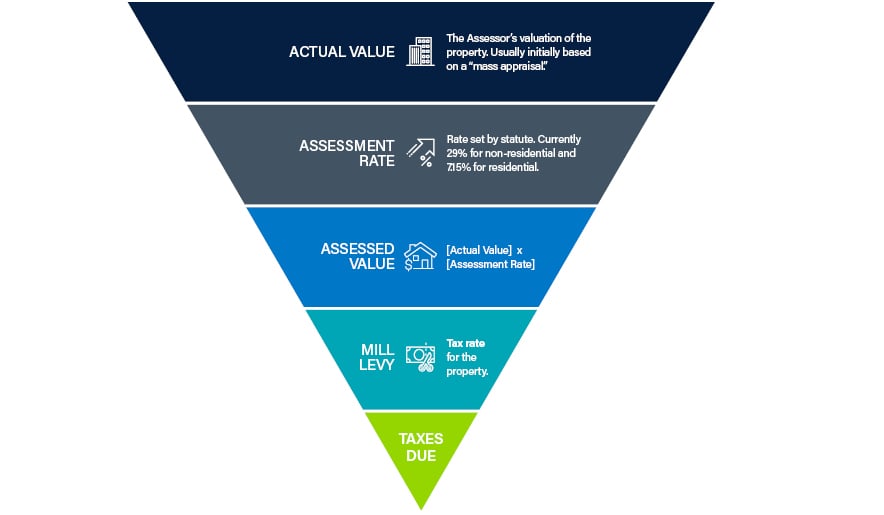

Colorado Property Assessments: Tax Assessment Overview

Colorado real property is generally assessed for tax purposes on a two-year cycle, which occurs every odd year. Real property is assessed by a tax assessor in the county in which the property is located. For commercial property, the assessor determines the “actual value” of the property by “appropriate consideration” of each of the three traditional appraisal methods: the cost approach, the market (or comparable sales) approach and the income approach.

Your property tax bill is then calculated by multiplying county’s determination of the actual value of your property by the “assessment rate.” The current assessment rate for residential properties is 7.15% and for non-residential properties it is 29%. This calculation gives you the “assessed value” of the property. Real estate taxes are then determined by applying what is referred to as a “mill levy” to the assessed value. The mill levy (or tax rate) for any given property varies; it might include mill levies from several different taxing districts, including schools, cities, county government, fire, water and sanitation, and/or special districts. Mill levies are expressed in percentages or “mills.” One mill is equal to $1 of property tax for every $1,000 of assessed value.

Calculating Property Taxes

The Importance of Date of Value to Your Tax Bill

As you can see from the above illustration, the assessor’s initial determination of the actual value of the property is a critical component of your property tax bill. Under Colorado law, the actual value of a specific property is determined as of a specific date in time, known as the “date of value.” The date of value under Colorado property tax statutes is June 30 of the year prior to the tax assessment year. That means that the date of value for tax year 2021 is June 30, 2020. For practical purposes, this means that county assessors are tasked with determining property values for tax year 2021 as they were on June 30, 2020. These values will most likely be applied to both tax years 2021 and 2022 since Colorado law dictates that both years in the tax reassessment cycle are to be valued equally, absent certain rare exceptions.

We need no reminders that June 30, 2020 was a particularly uncertain time in many households and industries. Commercial properties and hospitality were particularly hard hit in the middle of 2020. As a result, any commercial transactions, including new leases, that did occur in the lead up to June 30, 2020 likely did so at a discount. This discount should — but may not — be incorporated into a county’s valuation of a commercial property for tax year 2021.

Property owners will receive their 2021 Notice of Valuation on or before May 1, 2021. If the pandemic is not sufficiently factored into your property’s valuation, you should strongly consider contesting the valuation of your property under the timeline presented below.

Tax Appeal Timeline

To contest your tax bill, you must appeal to the proper tax body at the proper time. The below chart provides guidance on the entities that hear tax appeals and the timeframes to appeal.

County Assessor Appeal

- May 1: Taxpayers are notified of real estate valuations from the county assessor by this date. See C.R.S. §§ 39-5-121, 39-5-122.

- June 1: Deadline for taxpayers to protest real estate valuation to the relevant county’s assessor. See C.R.S. §§ 39-5-121, 39-5-122.

- Note: When the deadline falls on a weekend, then the filing deadline is the next business day. See C.R.S. § 39-1-120(3).

- Last working day in June (or August 15)*: Last day for county assessor to mail two copies of form denying tax protest (commonly referred to as Notice of Determination or NOD). See C.R.S. § 39-5-122.

- Note: Counties may elect an extended appeal process which gives them until mid-August to issue the NOD.

County Board of Equalization

- July 15 (or September 15, if extended process elected): Deadline for taxpayer to appeal Notice of Determination (NOD) to the relevant county’s board of equalization. See C.R.S. § 39-8-106(1)(a), (2)(a) (“Upon receiving a petition in the form described in subsection (1) of this section, the county board of equalization or its authorized agent shall note the filing of the petition, set a time for hearing of said petition, and . . . notify the petitioner by mail of such time for hearing.”).

- August 5 (or November 1, if extended process elected): The county board of equalization shall continue its hearings until all petitions have been heard, "but all such hearings shall be concluded and decisions rendered thereon by the close of business on August 5 of that year; except that, in a county that has made an election [to extend appeal deadlines], all such hearings shall be concluded and decisions rendered thereon by the close of business on November 1 of that year." C.R.S. § 39-8-107.

State District Court, The Board of Assessment Appeals, or Arbitration

- 30 Days from County Board of Equalization Denial Notice: A taxpayer whose property value protest to the county board of equalization was denied, in whole or in part, has 30 days from the post-mark date to submit an appeal to the Board of Assessment Appeals, the district court of the county where the property is located, or arbitration. See C.R.S. § 39-8-108.

Conclusion

Property taxpayers should not pay more than their fair share. That is particularly important in the midst of a devastating pandemic that has wreaked havoc on many individual and corporate pocketbooks. Thankfully, there are statutory and other legal mechanisms in place to ensure that your property is correctly valued and you are not taxed more than is appropriate. If you do not believe that the county assessor has properly valued your property as of June 30, 2020, you should strongly consider appealing your assessment. And because of the short timeframes involved, it is important to line up tax professionals early on who can help you or your company through the tax appeal process. If you have questions about the viability of a potential appeal, please refer to our Frequently Asked Questions page. And don’t hesitate to email us below.

.svg?rev=a492cc1069df46bdab38f8cb66573f1c&hash=2617C9FE8A7B0BD1C43269B5D5ED9AE2)