Benjamin Franklin’s famous statement — “in this world nothing can be said to be certain, except death and taxes” — remains true to this day. But while the need to pay taxes is unavoidable, the amount you owe for your real estate taxes is not necessarily so set in stone. That amount can be challenged if you think your property has been valued too high.

Colorado Property Assessments: Overview

Colorado real property is generally assessed for tax purposes on a two-year cycle, which occurs every odd year. Absent a statutory exception, the valuation of a taxpayer’s property for both years in the reassessment cycle should be the same. Real property is assessed by a tax assessor in the county in which the property is located. For commercial property, the assessor determines the actual value of the property by “appropriate consideration” of each of the three traditional appraisal methods: the cost approach, the market (or comparable sales) approach and the income approach. Tax assessors use data for the 18-month period beginning two years before the January 1 assessment date and ending six months before that date.

In most counties, assessors use the so-called “mass appraisal” process to initially determine a property’s value. A mass appraisal values a group of properties using common data, standardized methods and statistical testing. Because appraisers generally do not prepare a single-property appraisal at this initial stage, the unique characteristics of properties are typically not incorporated into a property’s initial assessment.

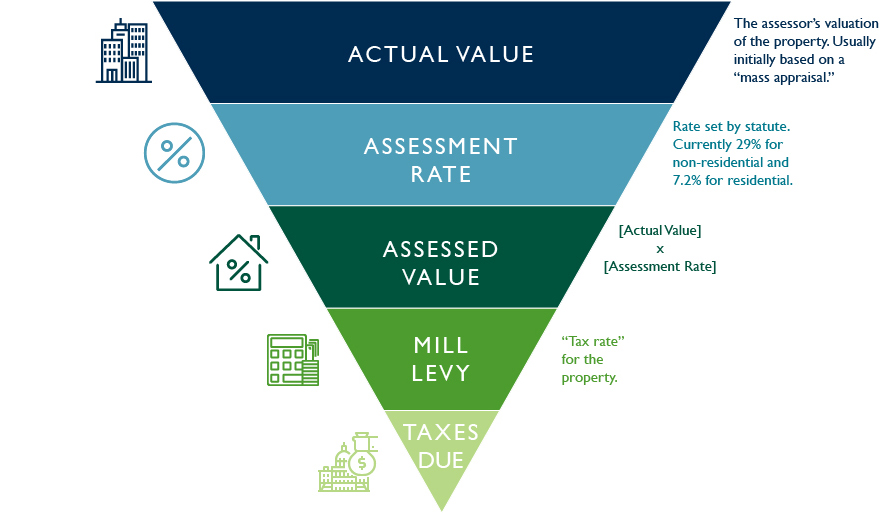

Your property tax bill is calculated by first multiplying the county’s “actual value” by the “assessment rate,” which for non-residential property is 29%. This gives you the “assessed value” of the property. Real estate taxes are then determined by applying what is referred to as a “mill levy” to the “assessed value.” The “mill levy” (or tax rate) for any given property varies; it might include mill levies from several different taxing districts, including schools, cities, county government, fire, water and sanitation, and/or special districts. “Mill levies” are expressed in percentages or “mills.” One “mill” is equal to $1 of property tax for every $1,000 of assessed value.

Calculating Property Taxes

Tax bills in recent years have steadily increased. Part of that increase may be attributed to rising real estate values for some properties in some parts of the state. However, many of those increases may also be due to aggressive valuations at the mass appraisal stage. If a property owner believes that its property is valued too high, it is important to preserve rights to challenge that value by appealing to the proper tax body at the proper time. The below chart provides guidance on the entities that hear tax appeals and the timeframes to appeal.

Tax Appeal Timeline

County Assessor Appeal

- May 1: Taxpayers are notified of real estate valuations from the county assessor by this date. See C.R.S. §§ 39-5-121, 39-5-122.

- June 1: Deadline for taxpayers to protest real estate valuation to the relevant county’s assessor. See C.R.S. §§ 39-5-121, 39-5-122.

- Note: When the deadline falls on a weekend, such as June 1, 2019, then the filing deadline is the next business day. See C.R.S. § 39-1-120(3).

- Last working day in June (or August 15)*: Last day for county assessor to mail two copies of form denying tax protest (commonly referred to as Notice of Determination or NOD). See C.R.S. § 39-5-122.

- Note: Counties may elect an extended appeal process which gives them until mid-August to issue the NOD.

County Board of Equalization

- July 15 (or September 15, if extended process elected): Deadline for taxpayer to appeal Notice of Determination (NOD) to the relevant county’s board of equalization. See C.R.S. § 39-8-106(1)(a), (2)(a) (“Upon receiving a petition in the form described in subsection (1) of this section, the county board of equalization or its authorized agent shall note the filing of the petition, set a time for hearing of said petition, and . . . notify the petitioner by mail of such time for hearing.”).

- August 5 (or November 1, if extended process elected): The county board of equalization shall continue its hearings until all petitions have been heard, "but all such hearings shall be concluded and decisions rendered thereon by the close of business on August 5 of that year; except that, in a county that has made an election [to extend appeal deadlines], all such hearings shall be concluded and decisions rendered thereon by the close of business on November 1 of that year." C.R.S. § 39-8-107.

State District Court, The Board of Assessment Appeals, or Arbitration

- 30 Days from County Board of Equalization Denial Notice: A taxpayer whose property value protest to the county Board of Equalization was denied, in whole or in part, has 30 days from the post-mark date to submit an appeal to the Board of Assessment Appeals, the district court of the county where the property is located, or arbitration. See C.R.S. § 39-8-108.

Conclusion

Taxes are a necessary part of government operations. However, property owners should not pay more than their fair share. There are statutory mechanisms provided to the public to ensure that your property is correctly valued and you are not taxed more than is appropriate.

.svg?rev=a492cc1069df46bdab38f8cb66573f1c&hash=2617C9FE8A7B0BD1C43269B5D5ED9AE2)